|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

How to Refinance an Underwater Mortgage Without HARP: A Comprehensive GuideRefinancing an underwater mortgage can seem daunting, especially without the Home Affordable Refinance Program (HARP) at your disposal. However, there are still viable options to explore. This article will guide you through alternative methods, providing valuable insights and practical tips for homeowners. Understanding Underwater MortgagesBefore diving into refinancing options, it's essential to understand what an underwater mortgage is. When you owe more on your mortgage than your home is currently worth, your mortgage is considered 'underwater' or 'upside down.' This situation can arise due to falling home prices or significant changes in the local real estate market. Challenges of Underwater Mortgages

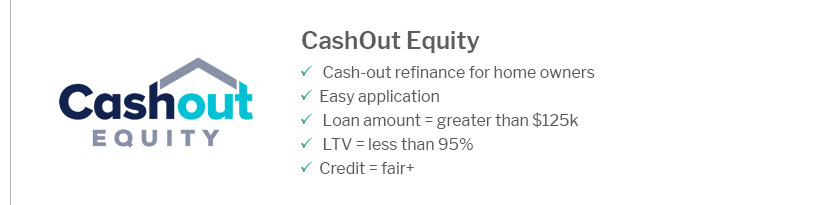

Exploring Alternative Refinancing OptionsWhile HARP was a popular solution for many, it expired in 2018. Fortunately, other refinancing options remain available for homeowners with underwater mortgages. Fannie Mae's High Loan-to-Value Refinance OptionThis program is designed to help homeowners with Fannie Mae-owned mortgages. It allows refinancing even if you owe more than the property's value. Freddie Mac Enhanced Relief RefinanceSimilar to Fannie Mae's option, this program helps those with Freddie Mac-owned loans. It provides a pathway to lower monthly payments and potentially reduced interest rates. Consider a refinance or home equity loanExploring other refinancing or home equity loan options might help you find a viable solution, even if your mortgage is underwater. Factors to Consider Before Refinancing

FAQs About Refinancing Underwater Mortgageshttps://www.rocketmortgage.com/learn/do-you-have-an-underwater-mortgage

You won't be able to refinance your loan if you're underwater. Most lenders need you to have some equity in your property before you refinance. https://www.lendingtree.com/home/refinance/harp-replacement-program/refinance-underwater-mortgage/

Learn what to do if you have an underwater mortgage. Discover your options and programs available to help you refinance and save money. https://www.homesteadfinancial.com/refinance/refinancing-without-harp/

If you're one of the millions of homeowners with an underwater mortgage who would still like to refinance but can't qualify for HARP (the ...

|

|---|